You’re here because you need… and hopefully love… marketing.

But we don’t have to go much deeper to get to the root of that seductive attraction.

Which is, of course… making money.

People equate the green stuff with a million other things… freedom, leisure, love, adventure, prestige, travel, excitement, power… planes, trains, and automobiles.

And there’s nothing we’re more screwed up about… except maybe love and relationships.

That’s why you need to consistently identify and deconstruct your limiting beliefs about this slippery subject.

So… last month I was at a friend’s house and got a chance to peruse his book collection.

In the money section were 2 books I hadn’t heard of and one I only had on audio… so I grabbed them.

Because if there’s anything that will rocket you to fortune… and possibly fame…

… It’s getting your head straight about the root of all evil.

And by the way, if you haven’t heard the correct interpretation of that Biblical passage… money itself is not that evil root… it’s the LOVE of money that is…

… Meaning a kind of twisted love… i.e., greed, hoarding, coveting, and tight-fisted stinginess.

OK then, without further ado, here’s the first of 3 books to shortcut your road to riches…

#1 — LOADED: How to Get Ahead Without Leaving Your Values Behind

I love this book because it cuts through the psychological smoke screen we use on ourselves.

In other words, it shifts our focus from changing the external to what’s happening on the inside.

Because until you get this, you’re just rearranging deck chairs on the Titanic.

Because until you get this, you’re just rearranging deck chairs on the Titanic.

And what does our author, Sara Newcomb, PhD, have to say about the matter?

Since she’s a behavioral economist at Morningstar and HelloWallet, … I’m inclined to take her seriously.

Besides, it’s not just theoretical.

She’s profoundly changed her own life and poverty mentality.

And, she’s surprisingly self-disclosing about being painfully conflicted about money (as most of us unknowingly are)…

“A person’s relationship with money is almost never about the numbers. It’s about the stories we tell ourselves because of those numbers. Each of us has come to believe certain stories based on our upbringing and our experiences with money: stories about who we are and who we are not, stories about what we can and cannot do in the world. This is where our relationships with money is rooted, and this is where sound money management begins. It starts with a story.”

That’s how Newcomb lays the foundation.

Then we get down to brass tacks and start digging up our hidden goofy beliefs by asking poignant questions.

Because you’ve gotta unearth those concealed controllers of our behaviors if you want to change them.

Here are a couple of her preliminary questions that scratch the surface:

>>> What situations do you avoid or fear because of money?

>>> Are you afraid that embracing wealth could make you a target for fraud, scams, or hostile envy from others?

>>> Do you ever feel worried that people will judge you negatively due to your socioeconomic status?

>>> Do you secretly fear that if you got rich, you might lose friends, or be judged by your loved ones?

>>> If money were a character in your life’s story, up to this point would you say it’s been a friend or an enemy?

You may find these questions simplistic or easy to dismiss…

… But if you really stop and look… slowly and deeply… these, and other questions Newcomb exposes… are powerful medicine that gets to the heart of what controls our financial destiny.

Here are a few more intriguing topics from the book:

- Money and Cognitive Psychology: How Specific Thinking Patterns Affect Financial Decisions…

- Why “Retail Therapy” Feels Good: Identity and Ego Depletion …

- Time and Money: Why We Always Want It NOW …

- Change the Strategy, Meet the Need …

One last example that shows how our money-management strategies are usually too knee-jerk and superficial… in reaction to symptom, as opposed to getting at the root cause…

One last example that shows how our money-management strategies are usually too knee-jerk and superficial… in reaction to symptom, as opposed to getting at the root cause…

Have you ever tried to save money by cutting out Starbucks and its “boil-the-frog” tab of $1500 a year?

But your good intentions give way in a week or so?

Why does this happen?

Because as usual, it’s really not about the cost of the coffee.

It’s about the ambiance, the smells, the people milling around, and the feeling that you belong and are worthy of a little luxury.

So of course your best-laid plans fail.

You just need to go deeper… and Newcomb shows you how to do it.

PLUS, she has research studies galore, stories, examples, and best of all… tools for change.

There are multiple appendices with exercises, questionnaires, and strategies that make it easier to achieve your dreams.

‘Nuff said. Now let’s check out a vastly different perspective, with a book I’ve mentioned before, but this time with more of its fascinating secrets…

#2 — Dollars And Sense: How We Misthink Money and How to Spend Smarter

Think you don’t have even MORE weird beliefs about money?

After reading Dan Ariely and Jeff Kreisler’s book “Dollars And Sense: How We Misthink Money and How to Spend Smarter” I’m surprised we’ve made it this far.

We all know that being rich is about more than just making money.

Don’t worry, I’m not about to go into some rant about how, “the best things in life are free.”

Even though that’s true, that’s not what we’re talking about, so back to the Benjamins.

What I’m referring to is how we spend money.

What I’m referring to is how we spend money.

Not just our personal habits, but the often universally weird and irrational things that most of us are doing that we’re not even aware of.

The “rationale” we use (and it’s in quotes because it’s anything but rational) is fascinating and at times a shade disturbing.

Exposing some of the mental magic tricks used to justify purchases, was mesmerizing at times.

I felt as though I was getting a leg up on my own weird financial bullshit behind my own back.

At times the ridiculousness of things I’ve done for years made me glad I was reading the book alone.

I couldn’t believe some of the “mental accounting” I’ve been doing my whole life.

The beauty of this book is that it doesn’t have even a hint of some of the weird shame tactics that other books on this subject don’t seem to be able to avoid.

The same ‘make a budget’ B.S. that has a lot of us rolling our eyes and feeling like the fun has just been taken out of spending all together.

Instead I walked away from this book feeling smarter and more on top of my decisions, less like I was being taken advantage of by my own internal shell game.

I can now more accurately assess what I want to spend my money on without being affected by some psychological sleight-of-hand I never really had a chance to see through prior to reading this gem.

I may never take a “sale price” in to account in the same way again.

Now that I’m more conscious of the sheer stupidity of being deeply impressed by getting a $100 shirt for $50 bucks when I normally wouldn’t spend more than $40.

Now I can’t unknow that I didn’t in fact save 50 bucks, but rather I was duped out of an additional 10 bucks.

Is the hundred-dollar shirt substantially better quality?

Probably not.

Do I have to give up feeling like I got a great deal?

Sort of.

Except now when I see that same price tag I think to myself…

“I remember when I fell for that. It used to cost me a lot of money.”

Money that I can now spend elsewhere.

Sure, a fairly obvious example, but there are dozens more that are like a hundred little apps running in the background that can quickly derail your hopes and dreams.

Add them all up and you’re like a puppet on a string.

I was dumbfounded when they pointed out that even if I was at the counter ready to pay, I would happily drive to a store 5 mins away to save 20 bucks on a 60 dollar pair of shoes. But that I would NEVER drive 5 minutes to save 20 bucks on a thousand dollar patio set.

IT’S THE SAME 20 DOLLARS.

Mind blown.

So if you’re looking for a fascinating, research-backed crash course in the psychology behind our most common hang-ups and delusions about all things money related, this book is your wisest purchase, even if you have to pay full price.

I found each revealing page was dispensed with levity making it that much easier to digest the absurdity and at times idiocy of our behaviors when it comes to money.

All the psychological snares and behavioral oddities that make us unwise when it comes to fiscal sense are fascinating.

A tedious but critical topic is explored and exposed putting it in a form that everyone can understand.

This book will be gifted to many an unsuspecting loved one in my life from now on.

#3 — How to Get Rich!

“How to Get Rich” is aptly titled and entertainingly well-written by a profligate poet, philosopher, publishing magnate, and philanderer.

It’s a good beginning to answering, “Do I really want this, and if so, how badly?”

It’s a good beginning to answering, “Do I really want this, and if so, how badly?”

I found myself newly reflecting on the specifics of what I really want, in terms of monetary success and what I am and am not willing to sacrifice in the name of such pursuits while reading this book.

Now in fairness, Felix Dennis’ definition of “rich” is pretty specific.

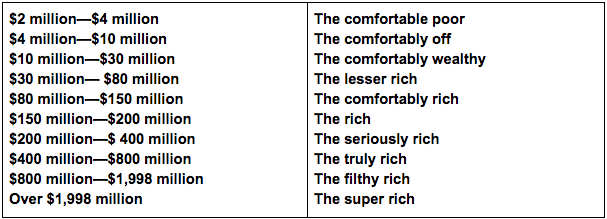

He offers 2 wealth measurement charts at the beginning of the book which cover cash-in-hand (or easily accessible cash) and total assets.

As far as he’s concerned, one only hits, ‘The Lesser Rich’ category if they can get their hands on 2-10 million dollars with relative ease or with total assets of 30-80 million dollars.

It’s so ridiculous and amusing that I’ve included it below for your viewing enjoyment.

Table 2: Wealth Measured by Total Assets (True Net Worth)

So, if it’s just a few paltry million you’re after, he’s not really addressing your crowd specifically.

His book however, is still ripe with insights for any entrepreneur, and it’s as entertaining as it is brutally honest about Dennis’s many financial disasters.

Like the part where John Lennon basically talks Dennis out of his dream of being an R&B singer… weird, but true.

In between tales of massive success and frequent failure, Dennis continues to remind us in every conceivable way that not everyone is cut out to travel the long and winding road to the kind of riches he’s referring to.

Sometimes it’s just as important to know what you don’t want.

With equal parts harsh truth and inspiring encouragement, you’ll leave this read feeling any number of things depending on your aspirations.

Some of the gold in this book rests in the internal shifts Dennis suggests when approaching the quest for great wealth.

In lieu of making a deal with the devil and exchanging your time, health and relationships for piles of treasures, Dennis proposes that one should approach the task as a game, something you can laugh about.

It’s sage advice considering how often it seems that most of us forget why we’re doing this in the first place, and when that happens it can become nothing but a different kind of drudgery.

Most people seek wealth for some version of freedom and options, and to be able to enjoy life and provide endless opportunities for those we love.

Shackled to the idolatry of of the Golden Calf, we could waste our whole lives if we’re not careful. Dennis consistently warns of this trap.

When he’s not bestowing hard-won lessons on the do’s and don’ts of gaining riches, he takes time to deliver some vivid warnings taken from his own garish and gluttonous stumbling:

“I spent millions of dollars on drinking, taking drugs and running around with prostitutes. I lost all respect for money and for the blood, sweat and treasure I had expended to acquire it. I was acting big.

In a single decade I got through more than a hundred million dollars living high on the hog. A single evening’s entertainment could come to thirty or forty thousand in the Big Apple, London or Hong Kong.”

This book is one part, “How To Get Rich,” and several parts how Felix Dennis got rich.

Any way you slice it though, it’s a fast and enjoyable read that feels a little like spending a weekend at one of his estates, drinking expensive wine and listening to him recount and distill the details of his life and times so you can avoid the mistakes he made.

Even if you decide you’re not on the road to hundreds of millions of dollars, you won’t be any poorer for having read it, I promise!

So that’s it for this week.

Leave a comment below about your own money discoveries and beliefs… how they afflict you or support you, how you’ve changed them, and the way you keep your own head straight.

Wishing you prosperity!

I read this some time ago. A good read. I need to read it again. But somehow didn’t he have some money to start with?

There are some good questions in there, and it’s time I answered them

Thanks for posting this.

I love to read and implement these strategies you give. I can relate to these books because I have been going through the same trials most of my life. I have also implemented strategies and didn’t even know it.

un grand bonjour…merci…